value appeal property tax services

How To Appeal Property Tax Assessment. These services are provided by.

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Contact Property Tax Service LLC PO.

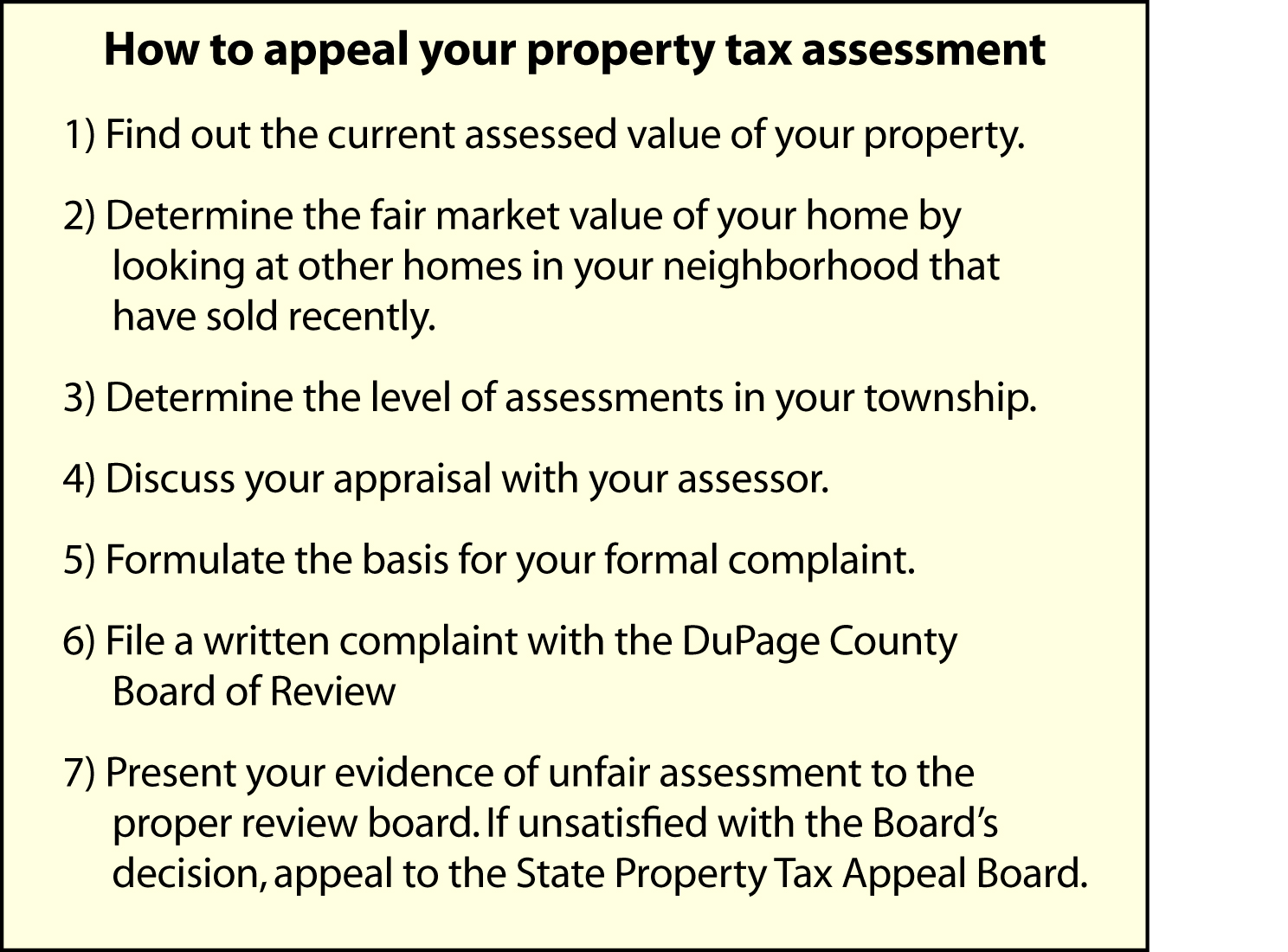

. There is an appeal process to assist property owners in presenting their concerns about property valuation. The assessor must enroll the lessor of the two. The first step is to look at your property tax bill and find the assessed value.

Property tax appeals are one area where a data-driven approach can lower costs and increase the value of multifamily real estate holdings particularly in times of unusual revenue pressure. 2022-23 Property Taxes. You may obtain petition forms.

Appeal Here Denver makes it very easy for you to appeal your property tax value. Most recent valuation notice only. The government uses the property tax money to fund various services and the public school system.

Box 481 McFarland WI 53558 608-833-4528. This is especially likely in high-tax high-cost states like New Jersey where a 600000 home with an effective 4 property tax rate carries a 24000 annual tax burden. Residents may call their County Tax Board for more information.

Decide If a Property Tax Appeal Is Worth Your Time. Value or does the ratio of my propertys assessed value to its market value exceed the upper limit of the common level range. Tax appeals are on assessments only.

Real estate value appeals may be filed. Simply go their website and search for your property address. When to File an Appeal - Within 60 Days of the Mailing Date of your Official Property Value Notice The Department of Assessments will be mailing Official Property Value Notice 1 cards for the.

If you disagree with the property values on your tax statement you may file an appeal to the Board of Property Tax Appeals no later than January 3 2023. This years property tax statements account for a total of 1385 billion which will pay for the services mentioned above. This is the value the assessor has placed on your.

Appeal Motor Vehicle Value Deadline. Taxpayers can file appeal online using. If the homeowners appeal is rejected ValueAppeal will refund 100 of their fee.

Value appeal property tax services. How much effort you decide to put into a challenge. Taxable value of real property is determined by the Factored Base Year Value or current market value as of January 1 of that tax year.

And basically the first step in this appeal is to write a letter to the tax assessors office. Single-family home owners in the US. While paying taxes is obligatory there are.

If you are appealing multiple vehicles please submit a separate form for each vehicle. In 2011 the average ValueAppeal customer saved over 1346 on their property taxes. Appeals of Property Assessment.

Right to Appeal If you believe that the assessed market value of your property is incorrect you may appeal to the Utah County Board of Equalization by filing an Appeal online mail or email. How much effort you decide to put into a challenge depends on the stakes. By law appeals may be filed by July 1st of each year but no later than 60 days after the mailing date listed on the Assessors Official.

Following is a table click on link for Chapter 123 Table you can use to determine your estimated market value and the Common Level Range for your property examples are for illustrative.

8 Steps To Appeal Your Property Tax Bill Kiplinger

Property Revaluation 701 Property Tax Appeal Math Are You Over Assessed A Tax Math Explainer Civic Parent

How To Lower Your Property Taxes In 4 Easy Steps

How To Appeal Your Property Tax Assessment

Property Tax Appeals Reduce Your Property Taxes

Township Of Schaumburg Calendar Event

Property Tax Protests Appeals Sopinski Law Office

Texas Property Tax Protests And Exemptions Ntpts

How To Appeal Property Tax Assessments L W Reedy

Why How When To Appeal Your Property Tax Assessment

Lake County Property Tax Appeals Dick Barr Lake County Board Member District 3

How To Appeal Your Property Tax Assessment Manatee County Florida

Property Tax Reduction Home Appraiser Services

How To Make Money With Property Tax Appeals Key Real Estate Resourceskey Real Estate Resources

How To Appeal A High Tax Assessment On A Home

Are You In The 60 Of People Overpaying Dispute Your Property Taxes